Campground owners, let us save you some time and share our current understanding of how you would calculate the loans you might be eligible for, and how you could calculate how much of that loan could be forgiven.

This week, The Dyrt team has spent a lot of time combing through the $2 trillion 880-page CARES Act, which is the historic economic stimulus bill signed into law last week. This includes the Paycheck Protection Program (PPP) Loan, that can help campground owners cover their payroll and some expenses over the next couple months.

Is your campground eligible for a Paycheck Protection Program (PPP) Loan?

Businesses, sole proprietors, franchisees, non-profits, independent contractors & the self employed are eligible if:

- You were you open before 2/15/20

- You have under 500 employees

How to Calculate & Request Your Campground PPP Loan Amount

For year-round businesses

Avg monthly payroll* during 2019 is ________ x 2.5 = _________

For seasonal businesses

Avg monthly payroll* between 2/15/19–6/30/19 is ________ x 2.5 = _________

For new businesses

Average Monthly Payroll* Costs 1/1/20 – 2/29/20 is ________ x 2.5 = _________

*Employee payroll is only eligible to be included for compensation less than $100,000

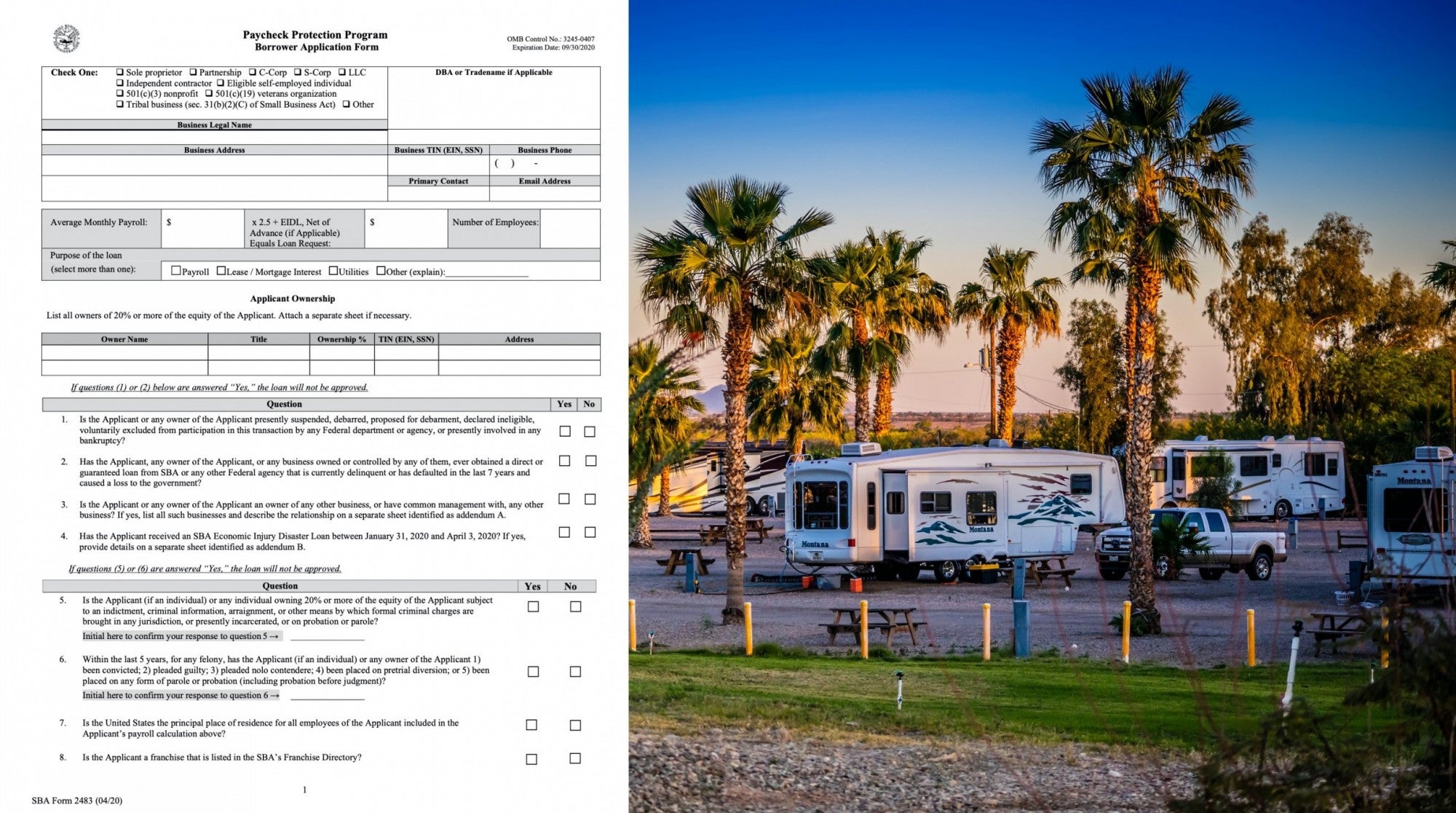

Then fill out the official loan request form (click to download): Official PPP Borrower Application (SBA Form 2483)

General Questions

How does the SBA forgivable loan calculation work?

Our understanding is that this loan is intended to provide you eight weeks of payroll relief during this unprecedented interruption. It covers eight weeks of payroll and some operating expenses to be spent after the loan is made. Hence, the formula is your average monthly payroll multiplied by 2.5 (2.0 for two months of payroll plus 0.5 for some operating expenses = 2.5 total).

How is my loan forgiven?

It is our understanding that — as long as loan proceeds are used to cover payroll costs, and up to 25% of mortgage interest, rent, and utility costs over the 8-week period after the loan is made — and as long as employee and compensation levels are maintained, you should have your loan forgiven.

How is Forgiveness $ Amount on my PPP Calculated?

At the end of the 8-week period, you would total your payroll, rent, mortgage, and utility charges. If you spent more than you were loaned and your employee level stayed the same, your loan amount may be forgiven. Whether or not it is forgiven will be determined by working with your SBA lender.

How do I apply for Forgiveness on my PPP Loan?

Forgiveness amount will be determined by working with your SBA lender.

Loan Terms for Portion of PPP Loan not Forgiven

Repayment term is 2 years at 1% APR.

Who should I get the loan from?

You need to go through an approved SBA lender. Most companies will utilize their existing bank relationships.

Note: I am not a lawyer nor an accountant, I’m just a small business owner sharing my current understanding of this opportunity, so please consult with your professional support staff on your wider research before taking action.